Expanding a tech business internationally can be a challenge, but these companies have made it and are now flag bearers of European innovation globally. France Digitale and its 30+ European partners present on stage at FDDAY in Paris the second edition of the Leading European Tech Scaleups (LETS), the only pan-European mapping of innovative companies that make at least 10 million EUR in global annual turnover across borders.

The LETS, the engine of Europe’s tech success

Competitiveness and innovation are Europe’s new obsession. But who can turn this ambition into reality? France Digitale and 32 startup organizations from across 20 European countries have scouted for the companies that are driving Europe’ innovation economy. The results are impressive.

The second edition of the Leading European Tech Scaleups (LETS) features 251 companies (up from 135 last year) founded after 2000 that make at least 10 million EUR in global annual turnover and successfully sell their product or service beyond their domestic market.

The LETS have a global footprint: 70% (174) of them have customers globally (beyond Europe), with North America (US and Canada) featuring as the top export market. The most populous European countries (France, UK, Germany) follow closely. Japan and Australia complete the top non-European export markets.

Internationalization patterns vary. Several LETS expand to their neighboring countries first, then to the US (it’s the case of many companies in software, finance, and health), while others jump straight from their domestic market to the US. Most companies in gaming, industry and services are global from day one, while scaleups in sectors involving last-mile logistics, like retail, transport and energy, tend to remain localized in Europe.

The LETS are great job creators: they employ on average some 415 people and plan to recruit more. Of 72 respondents, 94% declared having job openings: 53% are seeking between 11 and 50 talents and another 18% between 51 and 100 talents.

The LETS also stand out as solid partners for their customers and investors alike: 60% of them are already profitable and the remaining 40% expects to be so in the next 3 years.

Taking European tech to the next level

As positive as they are, these results raise two important questions. First, why does it seem more straightforward to export internationally, especially to the US, than to other European countries? Second, and most importantly: when and where will the Leading European Tech Scaleups “exit”?

While all LETS have customers in Europe, only a minority can claim to cover the whole continent. Indeed, the first barrier to export within Europe is fragmentation: despite the Single Market, Europe is still made of 27+ different markets, each with their own legislations. It can take from 3 months to 3 years to open another country, with regulated sectors like finance and health taking the longest.

The second challenge is exits. In 2021 alone, the US experienced more tech IPOs than Europe did over the entire period from 2015 to 2023, and 50 European-founded companies have filed for an IPO in the US since 2018, including UK-based companies. These “missed” IPOs account for a total economic loss of 439 billion USD since 2015. What could prevent history from repeating itself?

The newly-elected European Parliament and the next European Commission should make the answer to these issues a priority of their five-year mandate. Several actions can be taken in this sense: introducing a 28th company regime, allowing companies to do administrative procedures only once for the whole Single Market, and eliminating cross border transaction costs for equity investments to increase the liquidity of European financial markets.

Maya Noël, Managing Director of France Digitale, comments: “With LETS we celebrate the international success of companies that are flag bearers of European innovation worldwide. But we also highlight the work that remains to be done so that more companies can follow in their steps: completing the Single Market and achieving a fully-fledged Capital Markets Union”.

Explore LETS24 by country, sector and other key facts and figures here.

Introducing LETS24

Full list of LETS by country:

- Austria: Bitpanda, Byrd, GROPYUS, Tourradar

- Belgium: Deliverect, Showpad

- Bulgaria: Quantive

- Czechia: ADVACAM, Carvago, Choiceqr, Daktela, DoDo, Elmarco, IDEA StatiCa s.r.o. (form. IDEA RS s.r.o.), JetBrains, Kentico, Kiwi.com, Livesport, Make (ex Integromat), Notino, Prusa Research, Rohlik, ROI Hunter, Shoptet, Woltair, ZOOT

- Denmark: Dixa, Labster, Lunar, Pleo

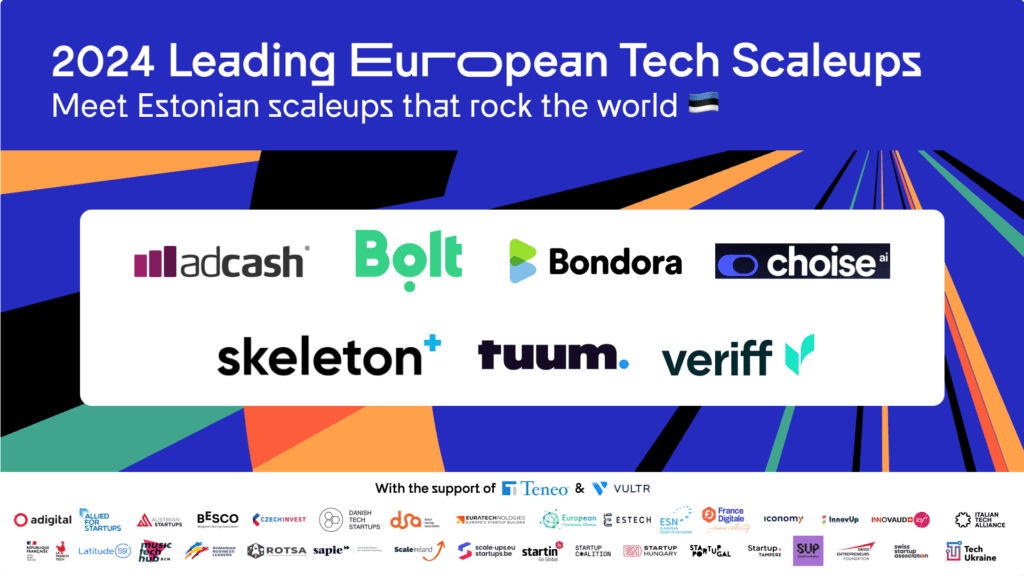

- Estonia: Adcash, Bolt, Bondora, Choise.ai, Skeleton Tech, Swappie, Tuum, Veriff

- Finland: Accountor HR Solutions, Framery, Grundium Oy, HappyorNot, Merus Power, Optofidelity Oy, Tamturbo, Treon, Wirepas

- France: 360Learning, AB Tasty, Adagio, Addguests (ex- Campings.com), Agicap, Agryco (ex-Agriconomie), Alma, Ankorstore, Back Market, Blablacar, Braincube, Brevo , Brut, Cafeyn Group, Certideal, ChapsVision, ChargeGuru, Crosscall, Deepki, Defacto, DentalMonitoring, Descartes Underwriting, Devialet, Doctolib, Driveco, DriiveMe, EcoVadis, Ekimetrics, Electra, Equativ, Eudonet, Evaneos, Exotec, GitGuardian, Gojob, Greenly, HOMA, iSupplier, Le Collectionist, Ledger, Libon, LumApps , Madbox, Malt, ManoMano, Mirakl, MWM, Mylight150, MYM, NW, papernest, Partoo, Payfit, PerfectStay, Planity, Platform.sh, Playplay, Positive, Preligens, Qonto, santévet, SECURE-IC, Selectra, Seyna Shift Technology, Shopopop, Skeepers, Sorare, Spendesk, Swile, TapNation, Unseenlabs, Vestiaire Collective, Virtuo Technologies, Voodoo, Weezevent, Weglot, WeMaintain, Withings, Younited, Yousign

- Germany: IDNOW, Urban Sports Club, Makersite

- Hungary: Bitrise, Shapr3D

- Ireland: Fenergo, Teamwork, Tines, Wayflyer

- Italy: Bending Spoons, WeRoad

- Latvia: Mintos

- Portugal: Powerdot

- Romania: Amber Studio SA, AROBS Engineering, Druid AI

- Slovakia: Gymbeam, Sensoneo

- Spain: Barkibu, BMAT, Cabify, Civitatis, Clikalia, Factorial, Glovo, Job and Talent, Sonosuite, StratioBD, Wallapop

- Sweden: Anyfin, Epidemic Sound, Klarna, Kry, Mentimeter, Mindler, Teamtailor, Voi

- The Netherlands: Backbase, Bird, Castor, Catawiki, Channable, ChannelEngine, Contentoo, Convious, Creative Fabrica, Crisp, Datasnipper, EclecticIQ, Eye Security, Fairphone, Fourthline, Framer, Gain.pro, Lepaya, Mews, Mollie, Nicolab, Nordsol, Otrium, Overstory, Picnic, Roamler, Samotics, Sendcloud, Source (AG), Swapfiets, Testgorilla, Tiqets, Trengo, Trunkrs, Trustoo, Vesper, Zivver, Fixico, Temper, Studocu, Shypple

- Switzerland: AKENES SA trading as Exoscale, Batgroup, beqom, Destinus, Ecorobotix, LIGENTEC SA, PriceHubble, Proton, SWISSto12 SA

- United Kingdom: Accelerant, Allica Bank, Arbolus, Artios Pharma, B2C2, Butternut Box, Cleo, CMR Surgical, Codat, Cognism, ComplyAdvantage, Curve, Daytrip, Flash Pack, Florence, Huboo, HungryPanda, Modulr, myenergi, OnlyFans, Perlego, proSapient, Rossum, Smart, Stenn, Sumsub, Tripledot Studios, Yoto, Zeelo, Zencargo, Zenobe Energy, Zilch, ZOE Health

Organizations involved: Adigital/Estech, Allied for Startups, Austrian Startups, BESCO – Bulgarian Entrepreneurial Association, CzechInvest, Danish Tech Startups, Dutch Startup Association, Euratechnologies, European Startup Network, European Champions Alliance, France Digitale, La French Tech, iconomy, Innovaud/Scaleup Vaud, Innovup, Italian Tech Alliance, Music Tech Hub Barcelona, Latitude59, Romanian Business Leaders, ROTSA- Romanian Tech Startups Association, SAPIE- Slovak Alliance for Innovation Economy, Scale Ireland, Scaleups.eu/Startups.be, Startup Coalition, Startup Hungary, Startup Portugal, Startin.lv, Startup Tampere, SUP46- Startup People of Sweden, Swiss Entrepreneurs Foundation, Swiss Startup Association, Tech Ukraine and Teneo.